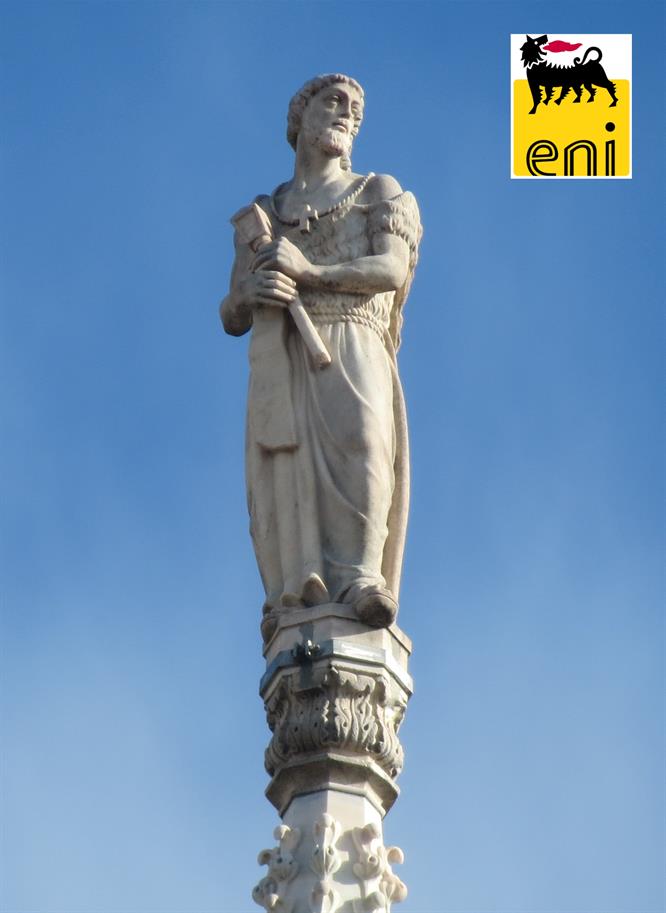

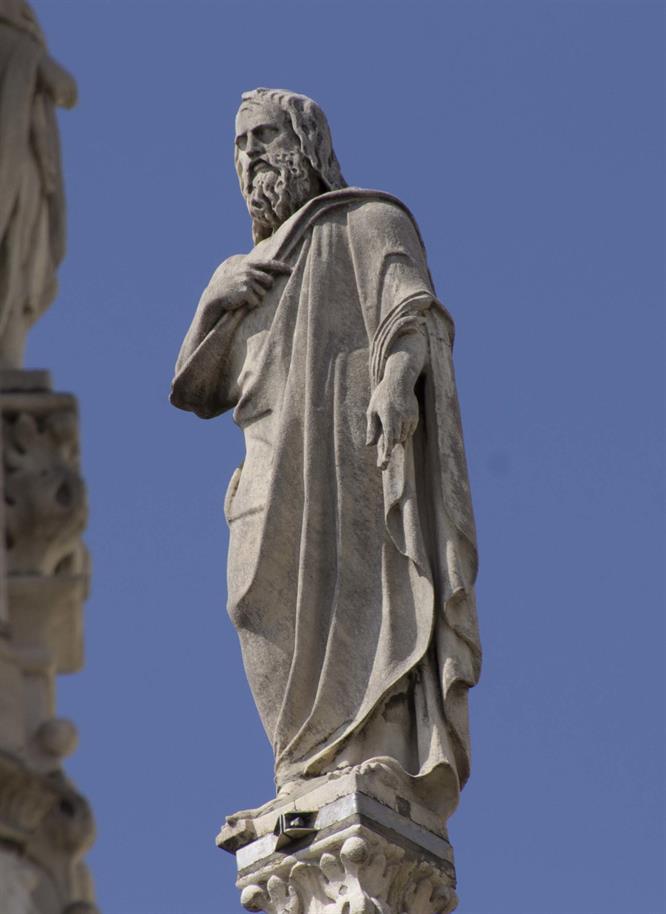

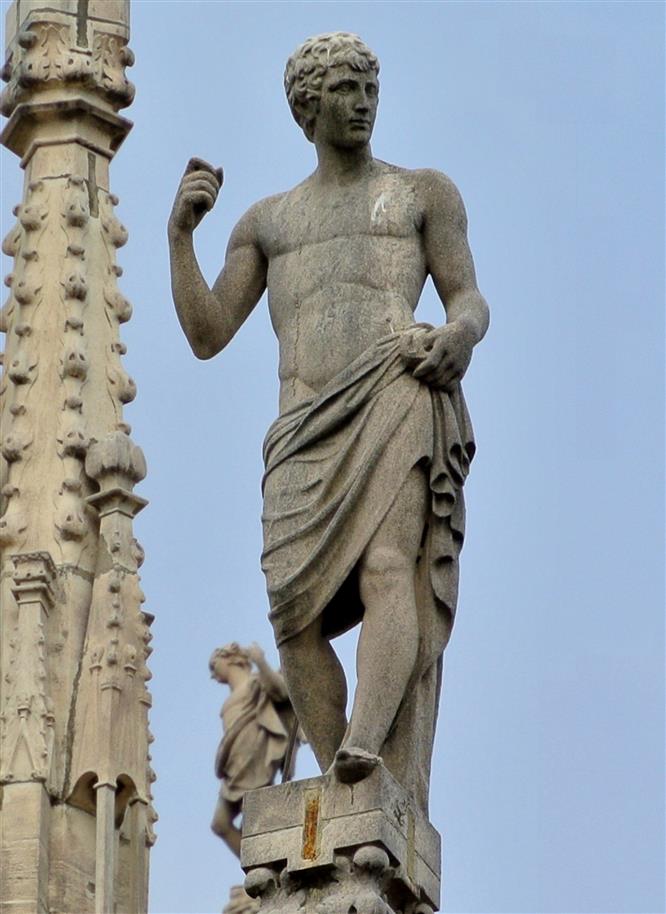

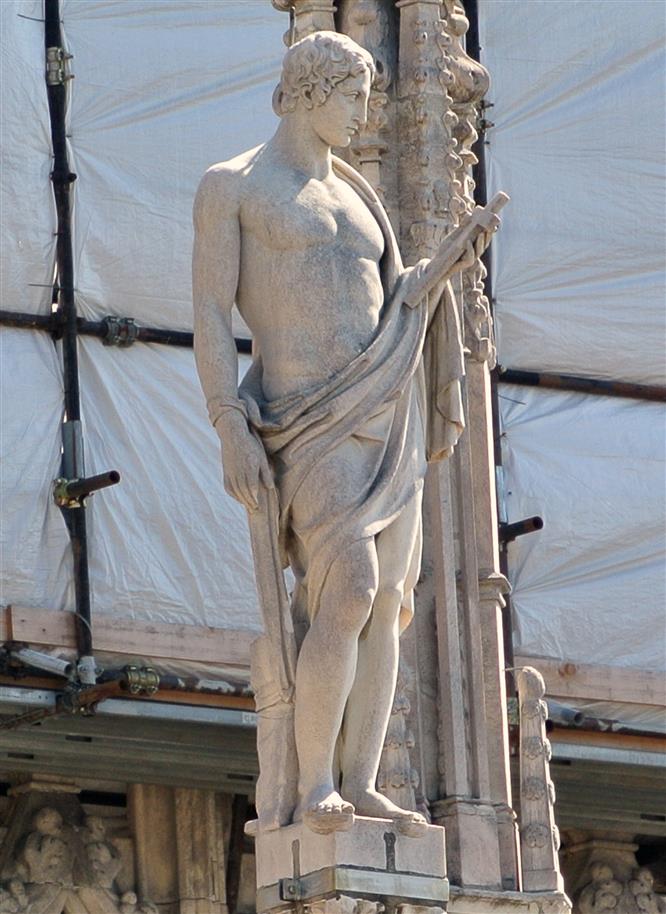

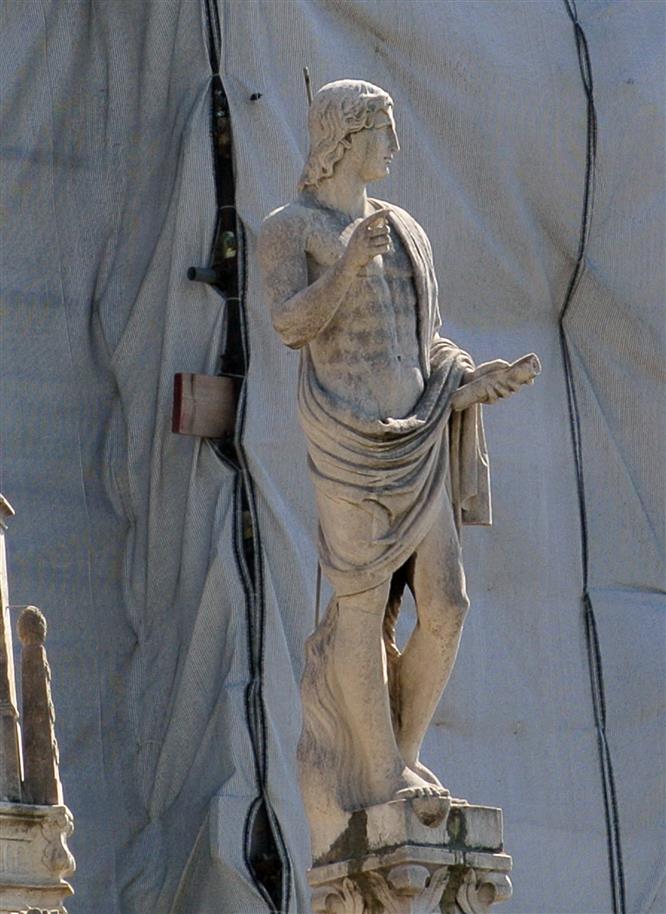

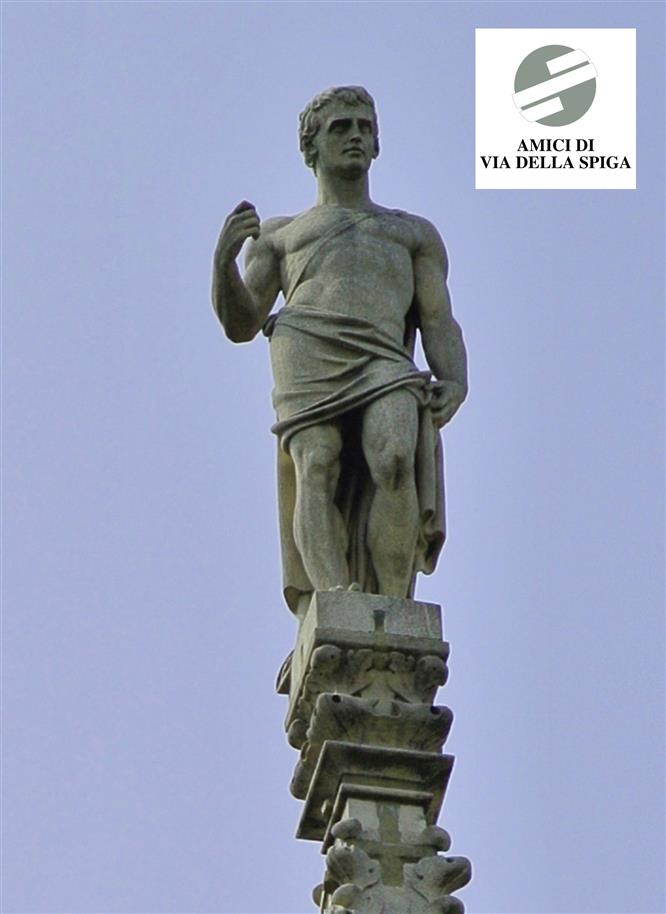

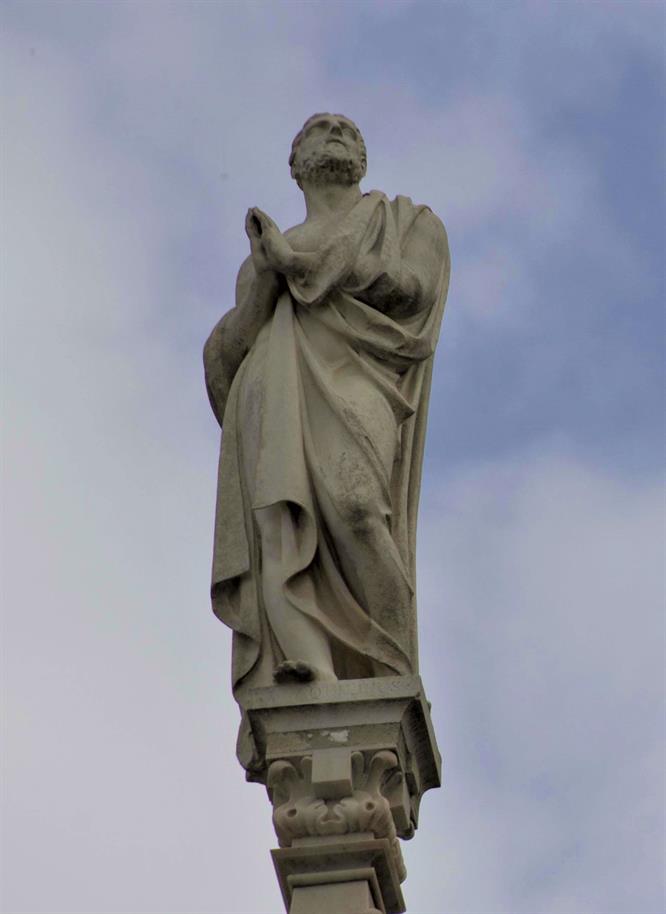

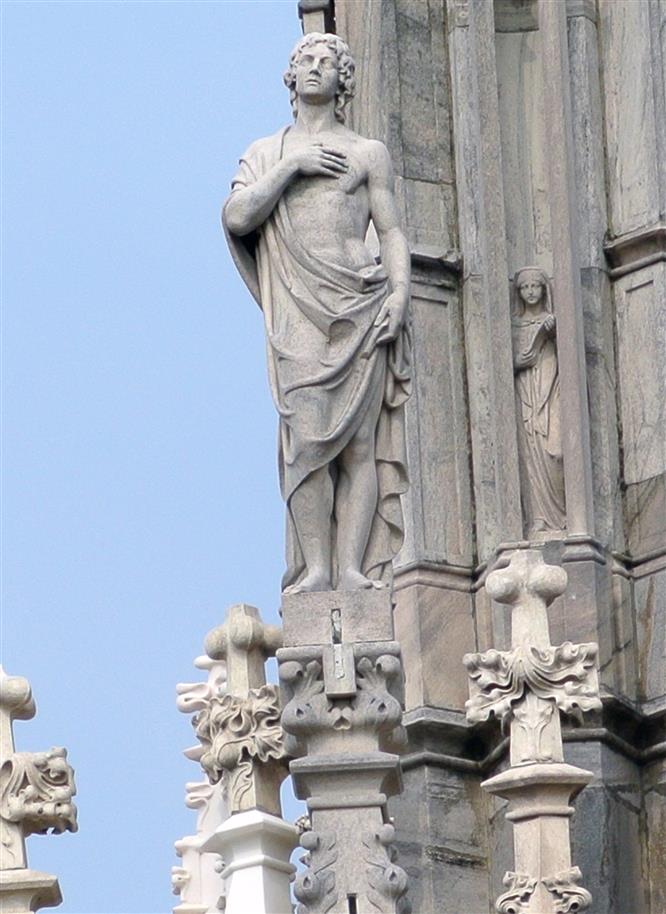

G111S. VITUS

St. Vitus is one of the 14 Holy Helpers, much venerated during the Middle Ages, whose intercession was considered to be particularly effective against illness or specific needs. The other thirteen Helpers are: Agathius, Barbara, Blaise, Catherine of Alexandria, Christopher, Cyriacus, Denis, Erasmus, Eustace, George, Giles, Margaret of Antioch and Pantaleon. Veneration for St. Vitus is documented from the end of the 5th century, but there is little and not very reliable information on his life. Some ancient texts say that he was from Lucania, but the 7th century passio leggendaria says that he was Sicilian. Born according to tradition in Mazara del Vallo into a rich family, after his mother died he was entrusted to a nurse named Crescentia and then to a tutor named Modestus, who as Christians converted him to their religion. He was about seven years old when he began to perform miracles and when in 303 AD Diocletian ordered the persecution of Christians throughout the Roman empire, Vitus was already very well known in the area of Mazara. His father, having been unable to persuade him to abjure his faith, since it is thought that he was by then an adolescent, reported him to the administrator Valerian, who ordered his arrest. It is not uncommon to find accounts in the Martyrologia of the age of persecutions telling of Fathers who, as convinced pagans, had one of their sons or daughters arrested for becoming Christian, fully aware of the torture and death that he or she would encounter. Such accounts, as it is well-known, were written centuries later under various titles and with the emphasis of heroic legends. Valerian attempted to make him abjure, using both threats and enticements, even the heart-broken pleas of his father, but without success; with their example of courage and loyalty to Christ, Crescentia and Modestus, who had been arrested too, gave their support to the boy. Given the uselessness of the arrest, Valerian sent him home. At this point, his father tried to tempt him with several women of easy virtues, but Vitus was incorruptible and, when Valerian was about to have him arrested again, an angel appeared to Modestus, ordering him to leave on a boat with the boy and his nurse. During the sea voyage, an eagle brought them water and food, until they landed at the mouth of the River Sele on the coast of Cilento. They then went further inland to Lucania (the ancient name of the Basilicata region, also used between 1932 and 1945). Vitus continued to perform miracles, so much so that he was considered an authentic thaumaturgist, bearing witness with his two companions to his faith with his words and with his feats, until he was traced by one of the soldiers of Diocletian, who took him to Rome to the Emperor. When the Emperor heard of the boy's fame as a healer, he imprisoned him to show him his son who was the same age as Vitus, but who suffered from epilepsy, an illness that at that time was horrifying, to the extent that those suffering from it were considered to be possessed by the devil. Vitus healed the boy but Diocletian ordered him to be tortured because he refused to make a sacrifice to the gods; here the legendary part of the ‘Passio’ was added, a part that is not so different in substance to the stories of other martyrs of that time. He was immersed in a cauldron of boiling pitch, from which he emerged unharmed; then they threw him amongst the lions who, instead of attacking him, suddenly became docile and licked his feet. The legend goes on saying that the torturers did not give up and hung Vitus, Modestus and Crescentia on a rack, but while their bones were being mangled, the earth began to tremble and the idols fell to the ground; even Diocletian fled in fear. Angels appeared and freed them, taking them back to the River Sele, at that time in Lucania, while today, after subsequent territorial divisions, flowing in Campania. By then, exhausted by the tortures they had undergone, the three died beside the river on 15 June 303. It has not been possible to ascertain how old Vitus was when he died. Some scholars say 12, others 15 and others still 17. Unfortunately it must be said that his martyrdom in Lucania is the only reliable item of information on St. Vitus, while all the rest appears to be legend. His cult spread through all Christendom, above all due to the young age of the martyr and his thaumaturgical talents. His help is invoked against epilepsy and chorea, a nervous disorder that causes uncontrollable movements, and for this reason also known as “St. Vitus's Dance”; he is also asked to intervene against excessive need for sleep and catalepsy, but also against insomnia as well as the bites of rabid dogs and possession by the devil. He protects the deaf, the dumb and, curiously, dancers too, due to the similarity of their movements to those of epileptics. Because of the huge cauldron in which he was immersed, he is also the patron saint of boiler makers, coppersmiths and coopers. According to a German version of the legend, in 756 Abbot Fulrad of Saint-Denis is said to have had the relics of St. Vitus transported to his monastery in Paris. Then in 836 Abbot Hilduin is said to have donated them to Corvey Abbey on the River Weser, which became an important centre for veneration of the young martyr during the Middle Ages. During the Thirty Years War (1618-48), the relics disappeared from Corvey and in the same period reached Prague in Bohemia, where the cathedral built in the 10th century was dedicated to the saint with a splendid chapel consecrated to him. It must be said that relics of St. Vitus can be found all over Europe. Some 150 small towns claim to possess his relics or fragments, including Mazara del Vallo, where an arm, a leg bone and other smaller bones are preserved. In the town thought to be his birthplace, St. Vitus is celebrated each year with a solemn and characteristic procession, which takes place between the third and fourth Sunday in August. The “fistinu”, in honour of the patron, commemorates the transfer of the mentioned relics, carried out in 1742 by Bishop Giuseppe Stella. The procession, thought to be the one held earliest in the morning in Italy, begins at 4 am, with the silver statue of the saint transported on the Triumphal float, pulled by fishermen to the little church of San Vito a Mare, accompanied by a picturesque torch-lit procession and fireworks; it is thought that the saint left this place by boat when he fled from his father and Valerian. A second procession is the famous historical-imaginary one with a tableau vivant: it comprises a series of floats, carrying people dressed as Christians of the time of St. Vitus, and depicting scenes from his life and his martyrdom; the triumphal float brings up the rear of the procession. “U fistinu” ends on the last Sunday of August with a final procession of triumphal float towards the canal harbour from where a simulacrum of St. Vitus is loaded onto one of the fishing boats and taken by sea close to the little church of San Vito al Mare, and then back to the harbour. In Rome there is a Church of Saints Vitus and Modestus, where a fresco shows the young man as well as Modestus with a teacher's cloak and a matronly Crescentia wearing a veil. In the German area, St. Vitus is depicted as a boy in a large cauldron, with flames below it. The sanctuary where he is venerated, located in an area formerly in Lucania, but now in Eboli in Campania, called San Vito al Sele, was known as “Alecterius Locus” that is the “place of the white cock”; in the nearby town of Capaccio, in the Church of San Pietro, there is a relic of the saint, while in the hamlet of Capaccio Scalo there is another parish church, it too dedicated to St. Vitus. The diocese of these towns where veneration of St. Vitus is so strong, because it was there that he died with his fellow martyrs, is still called Vallo della Lucania, even though it is in the province of Salerno. The saint is also the patron of Recanati and in Italy alone, there are no less than 11 towns that bear his name.